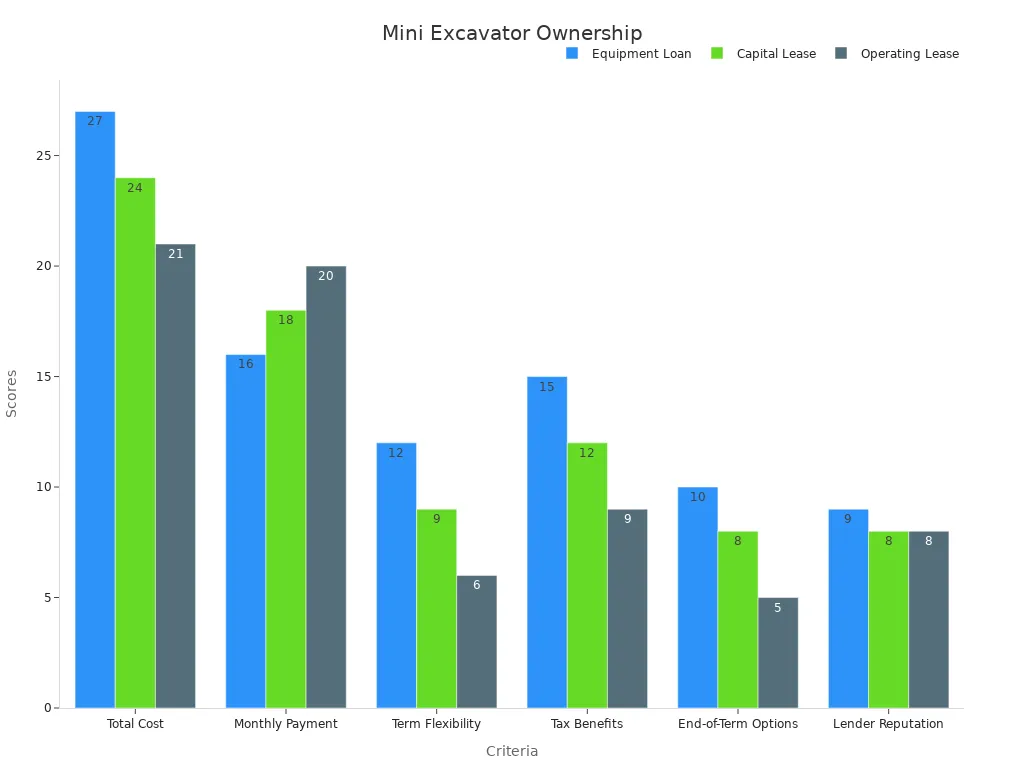

Choosing the best way to own mini excavators is important. It depends on what your business needs. It also depends on how much you use the machine. Your money situation matters too. Many companies look at different choices. They check total cost, monthly payment, flexibility, and tax benefits. The table below shows how these things affect your choice about business equipment:

Criteria | Weight | Equipment Loan | Capital Lease | Operating Lease |

|---|---|---|---|---|

Total Cost | 30% | 27 | 24 | 21 |

Monthly Payment | 20% | 16 | 18 | 20 |

Term Flexibility | 15% | 12 | 9 | 6 |

Tax Benefits | 15% | 15 | 12 | 9 |

End-of-Term Options | 10% | 10 | 8 | 5 |

Lender Reputation | 10% | 9 | 8 | 8 |

Total Score | 100% | 89 | 79 | 69 |

You should think about upfront cost and long-term value. Flexibility and tax benefits are important too. This helps you choose between cash, leasing, or Mini Excavator Financing.

Ownership Options for Mini Excavators

Quick Comparison Table

When you check mini excavator prices, you will see different ways to own one. The main choices are cash purchase, leasing, and financing. Each choice changes how you spend money and how much control you have. It also changes what you pay over time. The table below lets you compare these options easily:

Data Point | Cash Purchase | Leasing | Financing |

|---|---|---|---|

Ownership Status | You own it right away | You use it during the lease | You own it after paying off the loan |

Payment Structure | You pay all at once | You make regular lease payments | You make loan payments over time |

Cash Flow Impact | You spend a lot of cash at once | You pay less at first and save cash | You pay over time, which helps your cash flow |

Tax Benefits | You might get tax breaks or rebates | Lease payments can be tax-deductible | You can deduct interest and depreciation |

Maintenance Coverage | You must take care of repairs | Sometimes repairs or warranty are included | You handle repairs, but warranty may help |

Flexibility and Control | You can use and sell it as you want | You follow lease rules, but can buy or renew | You use it during the loan, then own it |

Risk Tolerance | No debt, but you take all the risk | Less risk, no need to keep it after lease | You have debt, but can own the equipment |

Cost Considerations | No interest, maybe a rebate | You pay lease fees, but do not own it | You pay interest, but rates can be low |

Equipment Lifespan & Resale Value | It can last long and keep value if cared for | Lease new models and avoid old equipment | Payments match how long you use the machine |

Growth & Expansion Plans | Uses your cash, not very flexible | Saves cash for other things | Lets you keep cash while still getting funds |

Which Option Fits Your Needs?

Pick your ownership option based on how you use mini excavators and your business plans. Here are some examples to help you choose:

If you only need a mini excavator for a short job or certain seasons, leasing or renting can save money and give you more choices. Many businesses lease or rent to avoid big upfront costs and stay flexible.

If you want to use the machine for many years, buying with cash or financing might be better. New equipment costs more, but you get full control and long-term value. Financing lets you pay over time, which helps your cash flow.

If you want to spend less, buying used equipment can cut prices by 30-40%. This is good if you want to save money and still use the machine for a long time.

Always think about the total cost, like repairs, insurance, and how much you can sell it for later. Doing regular maintenance and using telematics can help you take care of your equipment and avoid surprise bills.

Tip: Look at mini excavator prices, mini excavator cost, and rental costs before you choose to buy or rent. Pick what fits your business needs and your budget.

Cash Purchase

What Is Cash Purchase?

A cash purchase means you pay the full price for a mini excavator upfront. You do not need to apply for a loan or sign a lease. You own the equipment right away. This method gives you complete control over your machine from day one.

Pros of Cash Purchase

You can enjoy several advantages of cash when you buy equipment outright:

You avoid interest payments and extra fees. You only pay the sticker or negotiated price.

The transaction is fast and simple. You do not wait for loan approvals or credit checks.

You gain immediate ownership. You can customize the mini excavator to fit your needs.

The equipment becomes a business asset. This can increase your company’s value on the balance sheet.

You do not have monthly payments, so you do not worry about ongoing debt.

Tip: Paying with cash can give you peace of mind because you do not owe money to a lender.

Cons of Cash Purchase

Paying in full for a mini excavator also has some drawbacks:

You use a large amount of cash at once. This can limit your ability to make other big purchases.

Cash is a limited resource. Even strong businesses can run low on cash during slow periods.

You take on all the risk for repairs, storage, and insurance.

You do not get monthly expense deductions. This could raise your annual tax bill.

You must plan for future replacement costs as the equipment ages.

Best for Cash Buyers

A cash purchase works best if you have strong cash reserves and plan to use the mini excavator for many years. If you want a simple transaction and full control, this option fits your needs. You should also consider your business’s cash flow and future plans before making a purchase. If you need to keep your cash for other projects or emergencies, you might want to look at financing or leasing instead.

Mini Excavator Financing

What Is Equipment Financing?

Equipment financing lets you buy a mini excavator and pay over time. You get a loan from a bank or another lender. You make payments every month until the loan is paid off. When you finish paying, you own the mini excavator. This way, you do not spend all your money at once. Many businesses like equipment financing because it makes buying big machines easier.

Benefits of Financing

There are many good things about using mini excavator financing:

You can keep your cash for other things. Equipment financing helps your business keep enough money on hand.

You can take off loan interest or even the whole cost on your taxes with IRS Section 179.

You can choose how much to pay at first and how long the loan lasts.

You own more of the mini excavator as you pay.

Small monthly payments make it easier to buy and feel sure about your choice.

Many people now pick equipment financing because it makes it easier to get what they need. You do not have to wait a long time to save up money.

Drawbacks of Financing

Financing a mini excavator also has some bad sides. You should think about these money issues before you decide.

Drawback | Description |

|---|---|

You pay more in the end because of loan interest. | |

Longer Repayment Terms | More payments mean more interest, so you pay more overall. |

Rising Interest Rates | Rates went up from 3-4% to 8-9%, so loans cost more. |

Risk of Obsolescence | You might still owe money if the machine gets old or outdated. |

Collateral Risk | The lender can take the mini excavator if you do not pay. |

If you pick a longer loan, your monthly payment is lower but you pay more in total. Higher interest rates can make your costs go up by thousands of dollars.

Who Should Finance?

Mini excavator financing is best if you want to keep your cash, need easy payments, or want to own more of your machine over time. You should think about your credit, how big your business is, and if you make enough money. If you want your payments to match your income, financing can help. This choice is good for many businesses that want to grow without spending all their money at once.

Leasing Options

What Is Leasing?

Leasing lets you use a mini excavator without buying it first. You pay to use the machine for a set amount of time. There are two main types: operating lease and capital lease. An operating lease is for a short time. You give the excavator back when the lease ends. A capital lease is more like a loan. You make payments and might own the machine later. Leasing helps you get equipment without paying a lot at the start.

Advantages of Leasing

Leasing has many good points for your business. You keep your cash because you do not pay everything at once. Leasing helps you avoid big costs, which is good for short jobs or busy seasons. If you want new models often, pick an operating lease. This keeps your machines up to date. A capital lease lets you build equity and maybe own the machine.

Leasing can help your machines work better. Sapio Research found 92% of plant maintenance leaders saw better uptime with leased equipment. About 38% said they had at least 25% more uptime. You also have less risk. The company that owns the machine often pays for repairs and insurance.

Here is a table with the main benefits of leasing:

Benefit Category | Supporting Data |

|---|---|

Cost Efficiency | Rental equipment can earn about half its price each year over 7 years. |

Avoidance of High Upfront Cost | Leasing means you do not need a big first payment. |

Operational Reliability | 92% see better uptime; 38% see at least 25% more uptime. |

Flexibility and Technology | Leasing lets you use the newest and greenest machines. |

Risk Reduction | Leasing moves repair and value loss risks away from you. |

Disadvantages of Leasing

Leasing also has some bad sides. You do not own the mini excavator unless you finish a capital lease. With an operating lease, you must give the machine back. There may be limits on how much you use it. You might pay more if you go over those limits. Leasing can cost more if you use the machine for many years. You also cannot make big changes to the machine during an operating lease.

Best for Leasing

Leasing is best if you want to spend less at the start and stay flexible. Choose an operating lease for short jobs or if you want to upgrade often. Pick a capital lease if you want to keep the machine for a long time and maybe own it later. Leasing is good for businesses that want to save cash, lower risk, and use new technology.

Comparing Equipment Financing, Leasing, and Cash Purchase

Cost and Cash Flow

When you compare mini excavator cost, you should look at how each option affects your money now and later. Paying cash means you spend a lot at once. This can make it hard to pay for other things your business needs. Equipment financing lets you spread out the mini excavator cost over time. You make monthly payments, which helps you keep more cash for other uses. Equipment leasing also spreads out the cost and keeps your cash free for marketing or growing your business.

Leasing helps you avoid large upfront costs and keeps your working capital safe.

Spreading payments over a lease or loan term makes it easier to manage your cash flow.

You can use saved cash for other important business needs.

Equipment leasing works well for businesses of all sizes that want to control cash flow.

If you pay cash, you might miss out on chances to grow because your money is tied up. Financing and leasing both help you manage your cash better. When you do a cost comparison, always think about how each choice affects your cash flow and your ability to invest in your business.

Ownership and Equity

Ownership is a big part of your decision. If you buy with cash or use equipment financing, you own the mini excavator. This means you build equity as you pay off the loan. Leasing works differently. With a regular lease, you do not own the machine. You just use it for a set time. Some leases let you buy the equipment at the end, often with a small fee.

Feature | Lease Option | Lease Purchase |

|---|---|---|

Purchase requirement | Optional at lease end | Must buy at lease end |

Flexibility | Can walk away without buying | Must complete the purchase |

Upfront fee | Higher (often 20% or more) | |

Risk level | Lower for you | Higher commitment |

Equity accumulation | Rent premium builds purchase credit | Larger upfront equity needed |

Best for | Testing or uncertain needs | Long-term equipment use |

Credit impact | Can improve credit score | May need good credit upfront |

Lease-to-own options help you build equity with each payment. You pay a bit more each month, but this extra amount goes toward owning the machine. This can be a good way to get equipment if you want to test it first or if you do not have a lot of cash for a down payment. If you want full flexibility and ownership control, buying with cash or financing gives you that from the start.

Flexibility and Upgrades

Flexibility matters when your business changes or grows. Leasing gives you the most flexibility. You can upgrade to a new mini excavator at the end of your lease. This helps you keep up with new technology and lower your maintenance and operational costs. Financing gives you some flexibility, but you own the machine and must sell it if you want to upgrade. Cash buyers have full control but must handle selling or trading in the equipment.

Leasing works well if you want to try new models or need equipment for a short time.

Financing and cash buying suit you if you plan to keep the machine for many years.

Upgrading is easier with leasing, but you do not build as much equity.

When you compare options, think about how often you want to upgrade and how much control you want over your equipment.

Tax Implications

Taxes can change the real mini excavator cost. If you buy with cash or use equipment financing, you can often deduct the full cost or the interest on your payments. This can lower your tax bill. Equipment leasing also gives you tax benefits. Lease payments are usually tax-deductible as a business expense.

Cash and financing let you use IRS Section 179 to deduct the equipment cost.

Leasing lets you deduct monthly payments as an expense.

Always check with a tax expert to see which option gives you the best tax benefits.

Tax rules can change, so you should always look at how each choice affects your taxes before you decide.

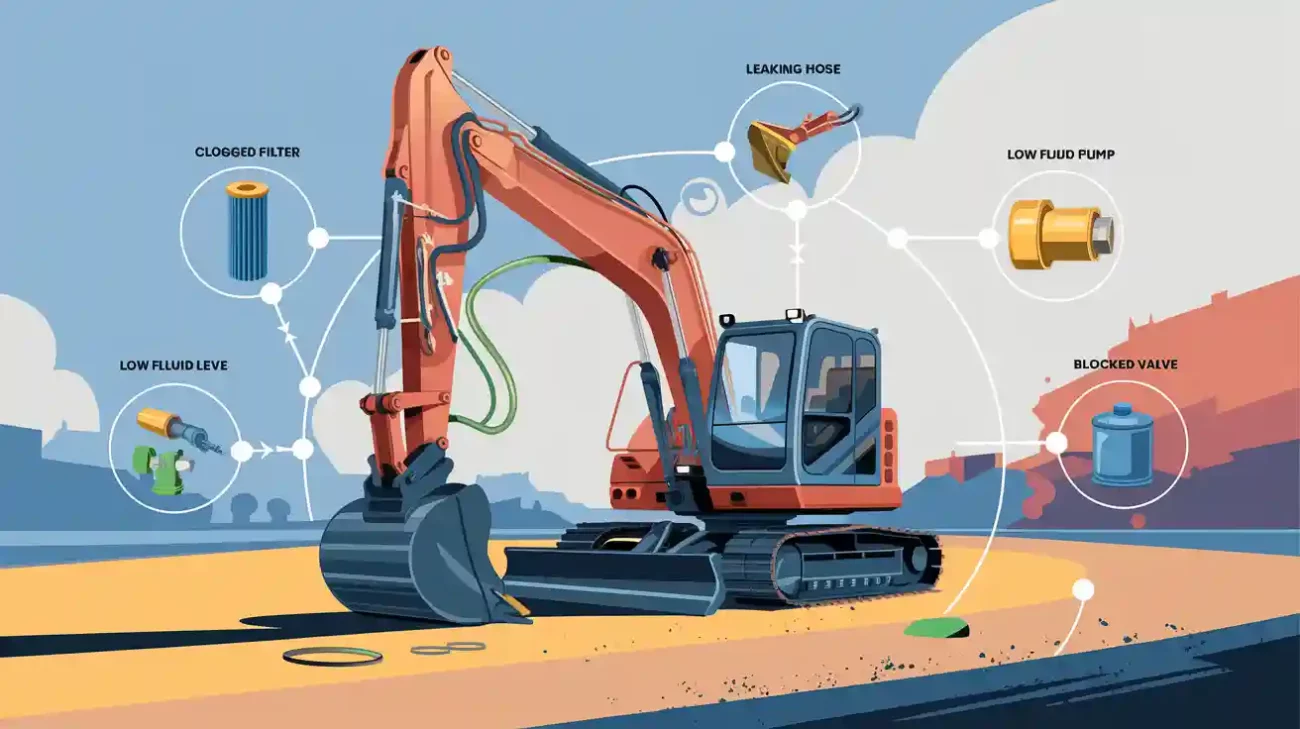

Risk and Maintenance

Risk and maintenance and operational costs are important when you choose how to get a mini excavator. If you buy, you take on all the risk. You must pay for repairs, insurance, and storage. These costs can add up, especially as the machine gets older. Equipment financing also puts these costs on you, but you may have a warranty for the first few years.

Leasing lowers your risk. Many leases include maintenance and insurance. This means you do not have to worry about big repair bills. You also avoid the risk of the equipment losing value over time. Renting or leasing works well if you want to avoid surprise costs and keep your business running smoothly.

Maintenance needs depend on the age and use of your equipment.

Owners must plan for repairs, storage, and insurance.

Leasing often covers maintenance, which can save you money and time.

When you do a cost comparison, always include maintenance and operational costs. This helps you see the true long-term investment for each option.

Tip: Good maintenance and operator training can make your mini excavator last longer and lower your total costs.

How to Choose the Right Option

Decision Checklist

A checklist can help you pick how to get your mini excavator. First, look at your budget and what jobs you need to do. Think about how often you will use the machine. Decide if you want a new or used mini excavator. Check the dealer’s reputation and what support they give. Good dealers help with repairs, parts, and training.

Here are some important things to think about:

Choose if you want a new or used mini excavator. Check how old it is, how many hours it has, and if it was cared for.

Pick a dealer that helps after you buy. This means you can get parts and learn how to use the machine.

Think about your needs, your money, and the help you will get.

Use more than one thing to decide. Look at how well it works, the price, and if the dealer is reliable.

You can use this table to help you decide:

What to Check For | Why It Matters | |

|---|---|---|

Technical Specs | Engine power, digging depth, attachments | Matches your job needs |

Financial Factors | Upfront cost, long-term value, financing options | Fits your budget and long-term plans |

Operator Comfort | Cabin design, seat comfort, visibility | Keeps workers safe and productive |

Maintenance Accessibility | Service intervals, warranty, parts availability | Reduces downtime and repair costs |

Supplier Support | Dealer reputation, after-sales service | Ensures help when you need it |

Tip: Always look at the total cost, not just the price. Think about fuel, repairs, and how long you will keep the mini excavator.

Common Scenarios

Looking at common business situations can help you choose. How much you use the machine, the size of your projects, and how often you need it all matter.

Factor | Scenario/Condition | Recommendation |

|---|---|---|

Utilization Rate | Renting is best | |

60% or more of the year | Buying is better | |

Project Duration | Short or one-time project | Renting is best |

Long or recurring projects | Buying is better | |

Project Size | Small landscaping jobs | Renting is best |

Large construction projects | Buying is better | |

Maintenance | Want to avoid repair costs | Renting is best |

Storage Space | No place to store equipment | Renting is best |

Frequency of Use | Year-round or frequent use | Buying is better |

If you use the mini excavator less than 40% of the year, renting saves money. If you use it most of the year, buying is smarter. Renting works for short jobs or if you have no place to store it. If you have big or long projects, owning gives you more value.

Note: Your business goals and cash flow should help you decide. Always check your needs before you choose.

Every way to own a mini excavator has good and bad sides. Buying with cash means you control the machine right away. Financing lets you pay over time and helps with your money plan. Leasing is good if you want more choices and less commitment. Think about what your business wants, how much money you have, and how long you will use the mini excavator. > For the best advice, ask a financial expert or a trusted equipment dealer. They can help you pick what is best for your business.

FAQ

What credit score do you need to finance a mini excavator?

Most lenders look for a credit score of 600 or higher. A higher score can help you get better rates. You should check your credit before you apply.

Can you buy a mini excavator at the end of a lease?

Yes, many leases let you buy the machine when the lease ends. You pay a set amount, called a buyout price. Ask your dealer about this option before you sign.

Is leasing better than buying for short-term projects?

Leasing works well for short-term jobs. You save cash and avoid long-term commitments. You also get newer equipment more often. Buying suits long-term use.

What costs should you expect besides the purchase price?

You should plan for insurance, maintenance, fuel, and storage. These costs add up over time. Always include them in your budget.

Can you write off mini excavator payments on your taxes?

You can often deduct lease payments as a business expense. If you finance or pay cash, you may deduct interest or depreciation. Always check with a tax expert.