You have several mini excavator financing choices available, with most lenders offering interest rates between 5.5% and 7.2% APR. You usually need a credit score of 600 or higher, a down payment of 0% to 20%, and at least one year in business. Some programs feature 0% financing, cash back, or flexible terms. The table below highlights typical requirements you may encounter:

Requirement | Typical Range | Notes |

|---|---|---|

Credit Score | 600-700+ | Higher scores may secure better rates |

Time in Business | 1-2+ years | Some lenders accept newer businesses |

Down Payment | 0-20% | Larger down payments improve terms |

Loan Term | 3-7 years | Common financing duration |

Interest Rate | 5.5%-7.2% APR | Typical APR range for equipment loans |

Tip: You can save money by comparing mini excavator financing options and looking for special offers.

What Is Mini Excavator Financing?

Why Finance a Mini Excavator

You may wonder why so many businesses choose to finance their mini excavators instead of paying cash upfront. Financing lets you spread the cost over several years, which helps you manage cash flow and keep more money available for other needs. Mini excavators are compact, versatile machines that work well in tight spaces and on precision jobs. Their popularity continues to grow as urbanization and infrastructure projects increase worldwide. In fact, the global mini excavator market reached $9.34 billion in 2023 and is expected to climb to $15.31 billion by 2032.

When you finance, you can take advantage of special manufacturer offers, such as 0% interest for 48 months or low rates for longer terms. You also gain flexibility. Leasing, for example, gives you lower monthly payments and the option to upgrade equipment as your business grows. Loans, on the other hand, lead to full ownership and possible tax benefits.

Note: Financing can help you match your payments to the expected lifespan of your equipment, making it easier to plan for future upgrades or replacements.

Here is a quick overview of mini excavator financing:

Aspect | Details |

|---|---|

Definition | Mini excavators are compact, versatile machines ideal for tight spaces and precision work. |

Financing Options | Traditional loans, equipment leases, rental programs, working capital loans. |

Loan Terms | Typically 24 to 72 months. |

Interest Rates | Range from 4% to 10%, influenced by financing type, lender, credit, and equipment condition. |

Credit Score Requirement | Generally 600+, with some lenders accepting lower scores with larger down payments. |

How Financing Works

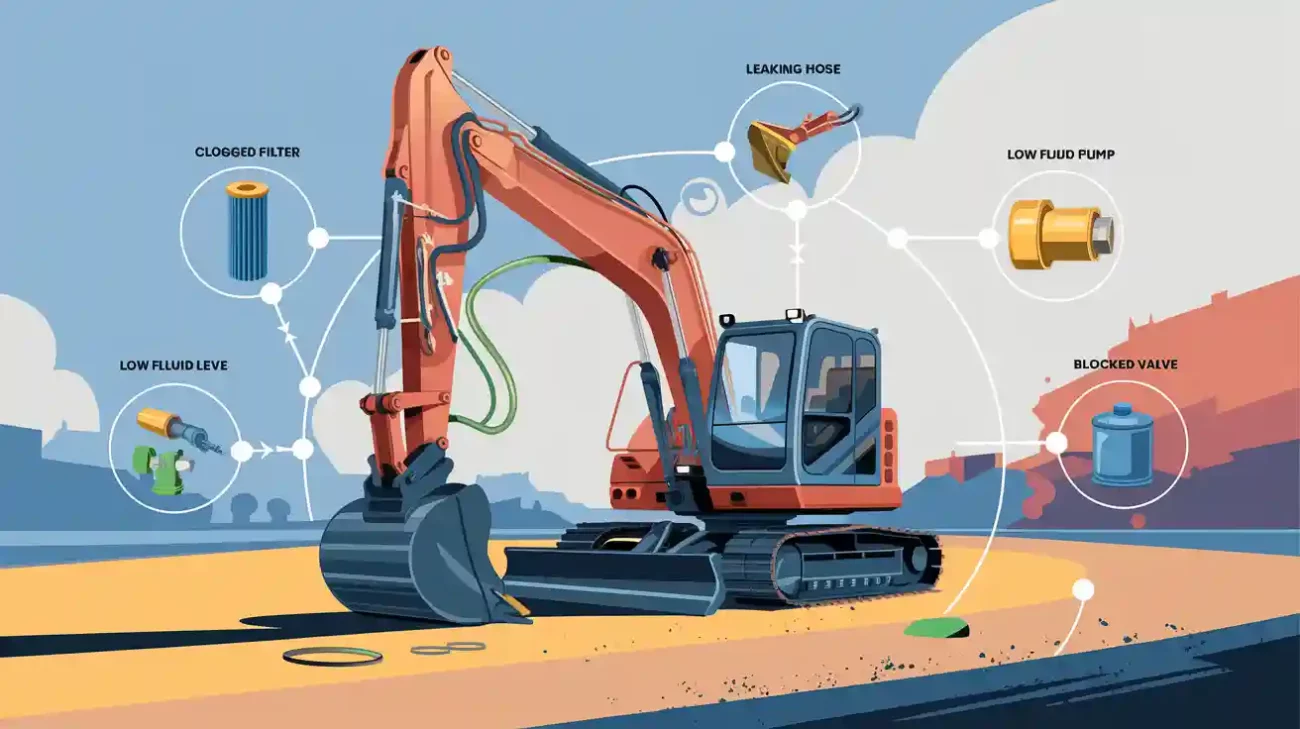

Mini excavator financing follows a clear process. First, you identify the right machine for your needs. Next, you choose a reputable dealer or consider auctions for used equipment. You then check the condition of the excavator and calculate the total cost, including transportation, maintenance, and insurance.

Once you select your equipment, you apply for financing. Lenders review your business history, credit score, and down payment. If approved, you sign an agreement that outlines your monthly payments, interest rate, and loan term. You get to use the mini excavator right away, and you make payments over time. At the end of the term, you either own the equipment or, if you leased, you may have the option to upgrade or purchase.

Tip: Financing helps you preserve cash for other business needs while still gaining access to essential equipment.

Mini Excavator Financing Options

When you explore mini excavator financing, you will find a range of options designed to fit your business needs. Each option offers unique benefits, from flexible payment plans to special manufacturer incentives. You can finance both new and used mini excavators, and many programs offer quick approvals, minimal paperwork, or even no payments for the first 90 days.

Bank Loans

Bank loans remain a popular choice for acquiring mini excavators. You can approach traditional banks or credit unions to secure funds for your purchase. These loans help you align equipment payments with your business cash flow, which improves your financial stability. Many construction companies use bank loans to access essential machinery, boosting productivity and expanding their capabilities.

You can often choose between fixed or variable interest rates.

Banks may offer longer repayment terms, making monthly payments more manageable.

Some banks require a strong credit score and a solid business history.

Note: Bank loans work well if you want to own your equipment outright and build equity over time.

Equipment Loans

Equipment loans are tailored specifically for purchasing heavy machinery like mini excavators. You receive immediate access to funds, and the excavator itself usually serves as collateral. This means you do not need to pledge additional assets.

Equipment loans help you preserve cash flow by spreading payments over several years.

Flexible payment schedules are available, including monthly, quarterly, or annual options.

You may qualify for tax deductions on loan interest, reducing your overall tax liability.

After you finish repaying the loan, you own the mini excavator outright.

Lenders typically look for a credit score of 600 or higher, at least one year in business, and a down payment of 10% to 20%. Some lenders offer up to 100% financing, and pre-approval options can make the process faster and easier.

Leasing

Leasing gives you another flexible way to access mini excavators without a large upfront investment. Leasing offers several types, such as operating leases, finance leases, fair market value leases, and dollar buy-out leases. Each type provides different term lengths and end-of-lease options.

Leasing supports flexible payment schedules, including seasonal and deferred payments.

You can conserve cash flow and avoid tying up capital in equipment.

Leasing often includes options to upgrade to newer models at the end of the term.

Tax advantages, such as Section 179 deductions, can lower your effective cost.

Leasing works especially well if you want to keep your equipment up to date or if you have fluctuating project needs. Over $4 billion worth of heavy equipment is leased each year in the United States, showing how common and beneficial this option is.

Tip: Leasing can be a smart choice if you want to avoid the higher interest rates and strict repayment terms that sometimes come with loans, especially if your credit is less than perfect.

Manufacturer and Dealer Programs

Many manufacturers and dealers offer special mini excavator financing programs. Brands like John Deere, Caterpillar, Komatsu, and Takeuchi frequently provide incentives to make equipment more affordable.

You may find 0% financing offers for up to 48 months, reducing your borrowing costs.

Cash back rebates can lower your total purchase price.

Some programs feature no payments for the first 90 days or require minimal paperwork for approval.

Manufacturer financing often includes flexible terms and tailored payment plans.

Dealers and manufacturers want to make mini excavator acquisition accessible for businesses of all sizes. You can often choose between financing new or used equipment, and some programs even include rent-to-own options.

Callout: Always ask your dealer about current promotions, as these can change throughout the year and may save you thousands of dollars.

Here is a quick summary of the variety of mini excavator financing options you might encounter:

Equipment loans, leasing, manufacturer financing, and rent-to-own programs.

Application-only, minimal disclosure, and full documentation financing.

Competitive rates with no hidden costs.

Flexible payment options and specialized products for different business needs.

By understanding these options, you can select the mini excavator financing solution that best supports your business goals.

Rates and Terms

Mini Excavator Financing Rates

You will find a range of interest rates when you look at mini excavator financing. Most lenders offer rates between 4% and 10% APR. Some manufacturers and dealers provide special promotions, such as 0% financing for up to 48 months. These offers can help you save money on interest, especially if you qualify for the best rates.

Your credit score plays a big role in the rate you receive. Higher scores usually mean lower rates. For example, if your score is above 700, you may qualify for the lowest advertised rates or even 0% promotional offers. If your score is closer to 600, you may see rates at the higher end of the range.

Many lenders also offer flexible payment options. You might see programs with no payments for the first 90 days or seasonal payment plans that match your business cycle. Some lenders allow you to pay off your loan early and receive a discount based on the number of payments you have made.

Here is a quick overview of current mini excavator financing features:

Feature / Criteria | Details / Range / Offer |

|---|---|

Interest Rate Range | 4% – 10% APR (0% promotional rates available) |

Deferred Payments | No payments for up to 90 days for qualified borrowers |

Seasonal Payments | Small payments allowed up to 90 days annually based on seasonality |

Early Payoff Discount | Discount based on number of payments made at payoff |

Funding Speed | Fast funding within 24-48 hours |

Application Fees | No application fees |

Down Payment | No down payment required (in some programs) |

Additional Collateral | No additional collateral required |

Loan Terms | Up to 60 months maximum term |

Tip: Always ask about current promotions. You may qualify for 0% financing or cash back, which can lower your total cost.

Loan and Lease Terms

When you finance a mini excavator, you can choose from a variety of loan and lease terms. Most loan terms range from 24 to 72 months. Some lenders offer terms up to 60 months as a standard option. Longer terms mean lower monthly payments, but you may pay more in interest over time.

Down payment requirements vary. Some programs require no down payment, while others may ask for 10% to 20%. In rare cases, you might see down payments as high as 50%, especially if you have a lower credit score or are financing used equipment. A larger down payment can help you secure better rates and lower your monthly payments.

Your monthly payment depends on several factors:

Loan amount

Interest rate

Loan term

Down payment

For example, if you finance $50,000 at 6% APR over 60 months with no down payment, your monthly payment would be about $966. If you put down 20%, your financed amount drops to $40,000, and your payment falls to about $773 per month.

Leasing offers even more flexibility. You can choose from operating leases, finance leases, or fair market value leases. Lease terms often run from 24 to 60 months. Leasing usually means lower monthly payments compared to loans. At the end of the lease, you may have the option to buy the equipment, return it, or upgrade to a newer model.

Your credit score and time in business affect your approval and terms. Here is a summary of typical requirements:

Financing Amount | Credit Score | Time in Business |

|---|---|---|

$3,000–$49,999 | 650+ | Startup to 1+ year |

$50,000–$100,000 | 600+ | 2+ years |

$100,000–$150,000+ | 625+ | 3+ years |

$150,000+ | 675+ | 2+ years tax returns |

Up to $250,000 | 725+ | 5-7 years |

Note: Strong credit and a longer business history can help you qualify for larger amounts, longer terms, and lower rates.

You can finance both new and used mini excavators. Some lenders approve applications with minimal paperwork and fund your purchase within 24-48 hours. Many programs do not require additional collateral beyond the equipment itself.

By understanding these rates and terms, you can choose the mini excavator financing solution that fits your budget and business goals.

Approval Requirements

Credit Score

Lenders look at your credit score first. A higher score shows you manage debt well. Most lenders want to see a score of at least 600. If your score is above 700, you can get better rates and terms. Some lenders accept lower scores, but you may need a bigger down payment or pay a higher interest rate. Good credit helps you qualify faster and makes the process smoother.

Tip: Check your credit report before you apply. Fix any errors to improve your chances.

Down Payment

You usually need to make a down payment when you finance equipment. The amount depends on the lender and your credit profile. Industry data shows most down payments fall between 10% and 20% of the equipment’s price. This range is common for equipment loans and helps lenders reduce risk.

Most lenders ask for 10% to 20% down.

Loans cover the rest of the equipment cost.

Leasing is popular too, but down payment details vary.

About 79% of construction companies use financing for machinery.

A larger down payment can lower your monthly payments and help you get approved.

Documentation

You must provide documents to prove your business and financial health. Lenders often ask for:

Business license or registration

Tax returns (1-2 years)

Bank statements

Equipment quote or invoice

Some lenders offer “application-only” programs for smaller amounts. For larger loans, you may need to submit more paperwork. Having your documents ready speeds up approval.

Collateral

Lenders use collateral to protect themselves. The mini excavator often serves as the collateral. If you default, the lender can take the equipment back. Collateral lowers the lender’s risk and can help you get better terms.

Aspect | Explanation | Statistical/Case Evidence |

|---|---|---|

Role of Collateral | Serves as security for lenders to reduce risk in loan approval. | Equipment is liened and can be repossessed if you default. |

Loan-to-Value (LTV) | Compares loan amount to collateral value; lower LTV means lower risk. | |

Impact on Approval | Lower LTV can get you better rates and longer repayment terms. | Example: 66.7% LTV led to a favorable rate and longer term. |

Collateral Types | Equipment and machinery are common collateral in construction loans. | Mini excavators are often used as collateral. |

Negotiation | Offering more collateral can improve your approval odds and loan terms. | You can negotiate collateral to get lower rates or a larger loan. |

Note: The equipment itself usually secures the loan, so you do not need to pledge other assets.

Improve Approval Odds

Strengthen Your Application

You can take several steps to make your mini excavator financing application stronger. Lenders want to see that you are reliable and that your business is healthy. Here are some ways to improve your chances:

Keep your credit score high. Lenders check your credit history to decide if you qualify and what rates you get.

Use collateral, like the mini excavator itself, to secure your loan. This lowers the lender’s risk and can help you get better terms.

Show that your business has more than one way to make money. Diversified revenue streams make you look more stable.

Prepare a clear business plan. Explain how you will use the mini excavator to grow your business and manage risks.

Keep your debt-to-income ratio low. This shows you can handle new payments.

Gather all your documents before you apply. Include financial statements, equipment quotes, and your financing preferences.

Highlight how the new mini excavator will help your business work better and grow faster.

Learn about the lender’s approval process. Address any financial issues before you apply.

Show steady cash flow and good money management. Lenders want to see that you can make payments on time.

Consider leasing if you want to keep cash flow strong and access new equipment without a big upfront cost.

Look into tax benefits, like deductions for lease payments, to improve your business’s bottom line.

Tip: Quick approval and fast equipment delivery help you keep projects on track and stay ahead of competitors.

Build Business Credit

Building strong business credit gives you more options and better terms when you finance equipment. Lenders trust businesses with good credit scores. You can improve your business credit by paying bills on time, keeping debts low, and checking your credit report for mistakes.

Lenders review your business’s credit score, cash flow, and debt-to-income ratio to decide if you qualify.

A higher business credit score shows you are trustworthy and increases your approval odds.

Fix any credit issues before you apply to make your application stronger.

Prepare a solid business plan, offer collateral, and build relationships with lenders to boost your chances.

A strong credit profile helps you get approved for mini excavator financing and other equipment loans.

Note: Building business credit takes time, but it pays off with better rates and more financing choices.

Compare Offers

Evaluating Terms

You should always compare financing offers before you make a decision. Each lender and dealer may present different terms, rates, and payment structures. Start by looking at the interest rate. Some programs offer 0% per annum, which means you pay no extra finance charges. Next, review the contract term. You might see terms up to 84 months, which can lower your monthly payment but may increase your total cost if interest applies.

Check the down payment percentage. Many lenders ask for around 10%. For example, if the manufacturer’s suggested retail price is C$107,575.00, a 10% down payment would be C$10,757.50. The financed balance becomes C$96,817.50. Your monthly payment could be about C$1,152.59 for 84 equal payments. Always confirm if taxes, delivery, and setup are included.

Here is a sample comparison table to help you evaluate offers:

Evaluation Criteria | Typical Benchmark |

|---|---|

Interest Rate | 0.00% per annum |

Contract Term | Up to 84 months |

Down Payment Percentage | 10% |

Monthly Payment Amount | C$1,152.59 (for 84 months) |

Total Finance Charges | C$0.00 |

Total Amount Payable | C$107,575.00 |

Additional Considerations | Subject to credit and dealer terms |

Tip: Always compare the total amount payable, not just the monthly payment. This helps you see the real cost.

Questions for Lenders

You should ask clear questions when you talk to lenders or dealers. This helps you avoid surprises and choose the best offer for your business.

What is the exact interest rate and are there any promotional rates?

How long is the contract term, and can you pay off early without penalty?

What is the required down payment?

Are there any fees for application, setup, or early payoff?

Does the offer include taxes, freight, and delivery?

What happens if you miss a payment?

Is the equipment the only collateral required?

Note: Write down each lender’s answers. This makes it easier to compare and choose the right financing for your mini excavator.

You have many mini excavator financing options to fit your business needs. Review your finances and gather documents before you apply. Real-world examples show how companies succeed with the right choice:

ABC Construction used leasing to finish projects on time and keep cash flow strong.

XYZ Manufacturing grew by securing an equipment loan tailored to their needs.

Check your credit, compare offers, and ask about current promotions to get the best terms.